Gold has always been considered a safe investment channel and a valuable asset with long-term sustainability. Buying and selling gold bars not only requires caution but also basic knowledge to make informed decisions. Let’s explore how to buy and sell gold bars effectively and safely.

1. What is a Gold Bar?

Gold bar, also known as a gold ingot or gold bullion, is a rectangular piece of gold produced by refineries or professional gold casting workshops. It is a standard form of gold commonly used for investment purposes and wealth storage. Gold bars are made from pure gold with high purity, usually reaching 99.5% or higher. Their weights vary, ranging from a few grams to several kilograms, with the most popular types being the 1-ounce, 10-ounce, 100-gram, and 1-kilogram gold bars.

In addition, each gold bar typically has important information engraved on it, such as weight, purity, and the name or logo of the refinery or mint. The gold used to produce the bar generally comes from gold mines or is recycled from used gold. The accuracy and quality of the manufacturing process ensure that gold bars are a reliable option for investors and those looking to accumulate wealth.

2. How much is a Gold Bar worth?

The value of a gold bar depends on its size, weight, purity, and the current market price of gold at the time of the transaction. The most common gold bar is the 1-kilogram bar, which is currently valued at approximately 84,958 USD (as of January 7, 2025).

Other gold bars also have notable values, such as the 400-ounce gold bar, valued at 1,057,024 USD, the 100-ounce gold bar, valued at 264,256 USD, and the 1-pound gold bar (approximately 0.45 kg), valued at 38,536 USD. For smaller bars, the value is lower, such as the 1-ounce bar at approximately 2,643 USD and the 1-gram bar, valued at 84.56 USD.

Gold prices fluctuate significantly due to economic, political factors, and supply-demand dynamics in the global market. Therefore, to know the accurate value at the present time, it is recommended to consult prices from reputable gold exchanges or institutions in this field.

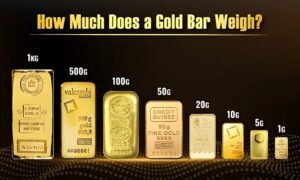

3. How much does a Gold Bar weigh?

A gold bar is one of the most popular forms of value storage worldwide. So, how much does a gold bar weigh? The weight of a gold bar can range from 1 gram (0.032 troy ounces) to 12.4 kg (400 troy ounces). These are the standard sizes widely used in international trading and investment.

Currently, 1 gram of gold is priced around $84.6, depending on market fluctuations.

A 400 troy ounce gold bar is valued at over 1 million USD, based on the current gold price.

Additionally, there are gold bars with less common weights on the market. For instance, the world’s largest gold bar weighs 250 kg (551 pounds) and is valued at over 21.2 million USD, becoming a symbol of wealth and power.

4. Who produces Gold Bars?

Gold bars are produced by various entities in the gold industry. The three main groups involved in this process are:

4.1 Gold Refiners

Gold refiners play an important role in producing gold bars. These specialized companies process raw gold materials, such as gold ore or recycled gold, and refine them to remove impurities, creating pure gold. The refining process follows strict quality control standards to ensure the gold reaches a high level of purity, meeting market requirements.

4.2 Minting Facilities

Minting facilities, either government-owned or private, are responsible for producing gold bars for investment or collectors. They take pure gold from refiners and use specialized equipment to cast the gold into bar shapes. Each gold bar is usually stamped with information such as weight, purity, and the mint’s logo or name, ensuring authenticity and value.

4.3 Banks and Financial Institutions

Some banks and financial institutions also participate in gold bar production, often collaborating with reputable mints or refiners. These gold bars may carry the bank or institution’s branding and often come with certificates or security features to enhance buyer trust.

4.4 Central Banks and the Gold Market

Central banks around the world are the largest holders of gold, with a total of 36,700 tons of gold as of 2023. This gold constitutes a large portion of the market capitalization of gold, valued at 17.85 trillion USD. Compared to other assets, gold maintains its position as an important asset with high security and long-term value.

5. How to buy a Gold Bar?

Buying a gold bar is a safe and valuable investment. To begin, you need to thoroughly research the different types of gold bars, including their size, weight, and purity. Currently, the most common gold bars have a purity of 99.99%. Additionally, regularly monitor gold prices in the market, as they can fluctuate daily, helping you determine the best time to buy.

A reputable seller is the most crucial factor when purchasing gold. You can visit established jewelry stores, certified dealers, or banks that offer gold bar sales services. Moreover, trusted online platforms are also a good option, but it’s essential to verify all information before making a transaction.

Before purchasing, you should set a specific budget. Gold bars come in various sizes, ranging from as small as 1 gram to as large as 1 kilogram or more. If you’re an individual investor, smaller gold bars will be more suitable. For larger investments, bigger gold bars are more cost-effective per gram.

Authenticity is a factor you cannot overlook. Check for identifying marks on the gold, such as stamps with weight and purity. Don’t forget to ask for a certificate from the seller to ensure the origin and quality of the product. A reputable seller will always provide this documentation.

Storing and securing your gold after purchase is also essential. You can choose to store your gold in a safe deposit box at a bank, use a home safe, or opt for specialized storage facilities. Each method has its pros and cons, but security should always be the top priority.

Buying and selling gold bars is a process that requires knowledge and careful preparation. By choosing the right time, a trustworthy seller, and planning for secure storage, you can optimize the value of your investment. Don’t forget to stay updated with information to ensure a successful transaction.

2 comments

32winapp

Just downloaded the 32WinApp, fingers crossed it’s gonna be a good one! Reviews look solid, time to see if it lives up to the hype. Give it a go: https://32winapp.org

jiliparkvip

Jiliparkvip sounds exclusive! Maybe I can become a VIP player someday. Gotta start somewhere, right? Go VIP with https://jiliparkvip.org!