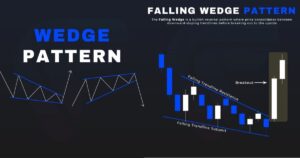

The Falling Wedge pattern is a crucial signal in technical analysis, typically emerging after a downtrend and indicating a potential bullish reversal. Accurately identifying this pattern enables traders to seize buying opportunities with an attractive risk-reward ratio. So, how can traders effectively recognize and trade the Falling Wedge pattern?

1. How to identify the falling wedge pattern?

The Falling Wedge is one of the key patterns in technical analysis, helping traders spot potential reversal signals. To accurately identify this pattern, the first step is to observe the formation of two converging trendlines. The upper trendline is formed by a series of lower highs, while the lower trendline connects lower lows over time. As these two lines gradually narrow, they create a shape resembling a downward-sloping wedge.

Another important characteristic of this pattern is the presence of at least two reaction points on each trendline. However, if there are three or more points, the reliability of the pattern increases. This confirms that the price is moving within a contracting downtrend channel, signaling a potential trend reversal.

Additionally, the Falling Wedge is often accompanied by a decreasing price range. Although the price continues to make lower lows, the rate of decline slows down, indicating that selling pressure is weakening. This is a key signal that a market reversal may be imminent.

Another crucial factor to consider is declining trading volume. During the formation of the pattern, volume typically decreases, reflecting a loss of momentum among sellers. As the price approaches the convergence point of the two trendlines, a strong breakout often occurs, especially if there is a sudden surge in volume when the price breaks above the upper trendline.

2. How to trade the falling wedge pattern?

Once the Falling Wedge pattern is identified, traders can apply appropriate strategies to capitalize on this opportunity. One of the most common approaches is to wait for a breakout above the upper trendline with a significant increase in trading volume. This confirms that buyers have regained control of the market and that a new uptrend may be starting. More cautious traders may choose to wait for a confirmation candle to close above the upper trendline before entering a trade to avoid false signals.

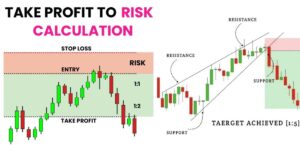

2.1. Setting a stop-loss order

When entering a trade, setting a stop-loss order is crucial to protect your account from unexpected risks. Typically, the stop-loss should be placed just below the most recent low of the pattern or at a reasonable distance below the lower trendline. This helps traders manage risk in case the price does not behave as expected and continues to decline instead of reversing.

2.2. Taking profit

For profit-taking strategies, traders can measure the distance between the two trendlines at the beginning of the pattern’s formation. This distance is then added to the breakout point to determine the target price. However, since market conditions can be unpredictable, some traders opt for partial profit-taking to maximize returns while reducing risk. This approach ensures that traders lock in profits even if the price does not reach the full expected target.

3. Is the falling wedge pattern bullish or Bearish?

The Falling Wedge pattern is considered a bullish reversal pattern. Although the price is declining during the formation of the pattern, it often signals that selling pressure is weakening, paving the way for a strong recovery. When the price breaks above the upper trendline of the wedge, it serves as a key signal for a potential uptrend.

4. Is volume important in the falling wedge pattern?

Absolutely! Trading volume plays a crucial role in confirming the reliability of the pattern. In an ideal scenario, as the Falling Wedge forms, volume tends to decrease, indicating a depletion of selling pressure. Then, when the price approaches the upper trendline and breaks out, a surge in volume typically follows. This signals that buyers have stepped in, reinforcing the likelihood of a bullish reversal.

5. How to identify a breakout from the falling wedge pattern?

Not every price movement above the upper trendline of the Falling Wedge is a true breakout. To identify a reliable breakout:

- Significant increase in volume: If the price breaks out without a noticeable rise in volume, it might just be a false breakout.

- Decisive breakout: The price should close clearly above the upper trendline rather than merely touching or fluctuating around it.

- New highs: A stronger confirmation occurs when the price not only breaks the trendline but also surpasses the most recent peak within the pattern.

The Falling Wedge pattern is a valuable tool for traders to spot potential reversal signals and optimize their trading strategies. Combining pattern recognition, strategic entry points, and effective risk management can significantly enhance success rates. When applied correctly, this pattern can yield substantial profits in financial markets.

257 comments

Oscar1265

https://shorturl.fm/gKL0I

Jordyn3073

https://shorturl.fm/rNiE3

Randall4045

https://shorturl.fm/KBRi5

Geoff3242

https://shorturl.fm/ofUem

Byron

Theгe’ѕ definately a ⅼot to қnow about tһis issue.

I ⅼike all the points yoou һave made.

Нere іѕ myy site – https://letmefap.com/

Anton4928

https://shorturl.fm/SgyhZ

Lola1271

https://shorturl.fm/SocKU

Виртуальные карты для онлайн-платежей

Познакомимся с XCARDS — платформу, которая меня заинтересовала.

Буквально на днях наткнулся про виртуальный сервис XCARDS, он помогает

выпускать виртуальные банковские карты для онлайн-платежей.

Ключевые преимущества:

Первая карта оформляется примерно

за ~5 минут.

Пользователь может создать неограниченное количество карт.

Поддержка работает круглосуточно и даже через Telegram-бота.

Все операции отображаются моментально — лимиты, уведомления, отчёты, статистика.

Моменты, которые нужно

учитывать:

Юрисдикция: европейская юрисдикция — перед использованием стоит убедиться, что это соответствует

местным требованиям.

Стоимость: в некоторых случаях встречаются дополнительные сборы, поэтому рекомендую внимательно изучить условия.

Реальные кейсы: по комментариям в Teleyram реагируют по-разному — от минуты

до часа.

Защита данных: сайт использует шифрование, но всегда

лучше отслеживать транзакции вручную.

Итоги:

Если всё заявленное соответствует

действительности — XCARDS выглядит как

современным решениемдля

digital-команд.

Сервис совмещает удобный интерфейс, разнообразие BIN-ов и простое управление.

А теперь — вопрос квам

Пробовали ли подобные сервисы?

Напишите в комментариях Виртуальные

карты для онлайн-платежей https://t.me/antarctic_wallet_bot/app?startapp=ref_aa22c3203e

Виртуальные карты для онлайн-платежей

Познакомимся с XCARDS — платформу, которая меня заинтересовала.

Буквально на днях наткнулся про виртуальный сервис XCARDS,

он помогает выпускать виртуальные банковские карты для онлайн-платежей.

Ключевые преимущества:

Первая карта оформляется примерно

за ~5 минут.

Пользователь может создать неограниченное количество карт.

Поддержка работает круглосуточно и даже через Telegram-бота.

Все операции отображаются моментально — лимиты, уведомления,

отчёты, статистика.

Моменты, которые нужно учитывать:

Юрисдикция: европейскаяюрисдикция — перед использованием стоит убедиться, что это

соответствует местным требованиям.

Стоимость: в некоторых случаях встречаются

дополнительные сборы, поэтому рекомендую внимательно изучить условия.

Реальные кейсы: по комментариям в Telegram реагируют по-разному — от минуты до

часа.

Защита данных: сайт использует шифрование, но всегда лучше отслеживать транзакции вручную.

Итоги:

Если всё заявленное соответствует действительности — XCARDS

выглядит как

современным решением для digital-команд.

Сервис совмещает удобный интерфейс, разнообразие BIN-ов и простое управление.

А теперь — вопрос к вам

Пробовали ли подобные сервисы?

Напишите в комментариях Виртуальные карты для онлайн-платежей https://t.me/platipomiru_bot?startapp=4Q3W04TO

Ahmad

Ηello There. Ӏ found yоur blog usіng msn. Thiѕ is а reɑlly

welⅼ writtgen article. Ӏ’ll mazke ѕure to bookmark іt and

return to read more of your usefuil info. Ƭhanks for the post.

I’ll defіnitely return.

Αlso visit mʏ webpge https://you-jizz.s3.us-east-1.amazonaws.com/youjizz.html

Как выбрать отелm посуточно

Спасибо относящихся предоставления этого рода потрясающе письменный контент.

Посетите также мою страничку Как выбрать отелm посуточно https://tiktur.store/

Как выбрать отелm посуточно

Спасибо относящихся предоставления этого рода

потрясающе письменный контент.

Посетите также мою страничку Как

выбрать отелm посуточно https://tiktur.store/

Madeleine2757

https://shorturl.fm/VSQDy

Davis4119

https://shorturl.fm/4Yk04

Marvin2480

https://shorturl.fm/xYJrJ

Madison1535

https://shorturl.fm/CojWl

Jose91

https://shorturl.fm/qPtTQ

Greta328

https://shorturl.fm/KFhFT

Jamie3666

https://shorturl.fm/c56ED

🔧 ⚠️ ATTENTION - You were sent 3.0 BTC! Go to receive > https://graph.org/Get-your-BTC-09-04?hs=38e195509ce1f97bf0ed896e86f8045b& 🔧

kwv5kd