The crypto market is full of potential but also highly complex, requiring investors to leverage effective tools to maximize success. This article will introduce leading tools to help you monitor, analyze, and manage cryptocurrency trading in a simple and professional manner.

1. Types of Crypto

In the current cryptocurrency market, crypto is generally categorized into two main types, each with distinct characteristics and roles.

1.1 Token

Tokens are cryptocurrencies issued by projects that utilize existing blockchains. Most tokens today are built on the Ethereum platform due to its flexibility and widespread adoption.

In addition to Ethereum, some projects choose other blockchains like Bitcoin, Solana, or Avalanche to develop their tokens. Tokens are often used to perform specific functions within the ecosystem of a project, such as paying transaction fees, granting voting rights, or being used in decentralized applications (dApps).

1.2 Coin

Unlike tokens, coins are developed on independent blockchains and can operate autonomously. Coins are typically designed to address broader issues such as payments, financial applications, or data security.

Notable examples include Bitcoin (BTC), the first cryptocurrency, and Ethereum (ETH), the largest blockchain platform for decentralized applications. With their independence and high applicability, coins play a crucial role in the cryptocurrency ecosystem.

2. Tools to support Cryptocurrency trading

Using cryptocurrency trading tools not only helps you capture market information quickly but also enables you to make more accurate investment decisions. Below are some of the most popular tools and their roles in cryptocurrency trading.

2.1. CoinMarketCap

Purpose: Track prices, trading volumes, and market capitalization of cryptocurrencies.

Key features:

- Detailed displays of prices, trading volumes, and other essential indicators.

- A comprehensive list of coins, exchanges, and detailed information.

Why use it:

CoinMarketCap is a fundamental tool for any investor to track price fluctuations and assess the health and potential of cryptocurrencies.

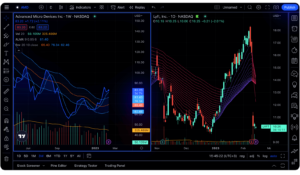

2. TradingView

Purpose: Perform technical analysis and predict price trends.

Key features:

- Intuitive price charts with advanced indicators like RSI, MACD, and Bollinger Bands.

- Tools for drawing and analyzing price trends in real time.

Why use it:

If you base your trades on technical analysis, TradingView is indispensable. It supports informed trading decisions through data-driven insights and clear trends.

3. Binance Research

Purpose: Conduct in-depth research on cryptocurrency projects.

Key features:

- Detailed reports on technology, development teams, and project visions.

- Clear market and coin analyses.

Why use it:

Before investing in a new cryptocurrency, understanding the underlying project is crucial. Binance Research provides in-depth information to evaluate a project’s potential accurately.

4. CoinGecko

Purpose: Monitor prices and evaluate emerging projects.

Key features:

- Updated details on ICOs, DeFi, NFTs, and the latest trends.

- Coin rankings based on multiple criteria.

Why use it:

If you’re interested in exploring new projects or diving into the DeFi market, CoinGecko is ideal for keeping up with trends and investment opportunities.

5. Glassnode

Purpose: Analyze on-chain data from major blockchains.

Key features:

- Monitor trading volumes, active wallet addresses, and other on-chain metrics.

- Evaluate market behavior based on real data.

Why use it:

Glassnode offers deeper insights into the fundamental factors of the cryptocurrency market, helping you make investment decisions based on data rather than emotion.

6. Messari

Purpose: Stay updated on news and conduct in-depth market research.

Key features:

- Reports analyzing trends and market news from leading experts.

- Detailed data on individual projects and investment trends.

Why use it:

Messari is a reliable source for quickly grasping trends and the latest news in the crypto world, helping to shape strategic decisions.

7. Reddit & Twitter

Purpose: Follow the community and keep up with market news.

Key features:

- Connect with a global community of investors.

- Easily follow prominent investors and gain market forecasts.

Why use it:

The crypto market thrives on global community participation. Reddit and Twitter provide fast access to the latest insights and connections with like-minded investors.

3. Where is Crypto stored?

Cryptocurrencies (Crypto) are stored in digital wallets, which help secure and manage digital assets effectively. Currently, there are two common types of wallets that investors typically use: cold wallets and hot wallets.

3.1 Cold wallets

Cold wallets are designed to function entirely offline, stored on specialized devices. Investors can only access their funds if they possess the physical device. These wallets are ideal for long-term investors who hold large amounts of cryptocurrency and rarely engage in transactions.

Thanks to their offline operation, cold wallets offer extremely high levels of security, making them virtually immune to cyberattacks and reducing the risk of Crypto theft. Popular cold wallets include Ledger Nano X, Trezor, and Coldcard.

3.2 Hot wallets

Hot wallets, as the name suggests, require an Internet connection to operate. This makes them more suitable for short-term investors who frequently trade and need convenient access to their funds.

However, because they are always online, hot wallets are more vulnerable to hacking and theft if not properly secured. Popular hot wallets include MetaMask, Trust Wallet, and Coinbase Wallet.

Choosing between cold wallets and hot wallets depends on your investment strategy, desired level of security, and transaction frequency. Carefully evaluate your options to ensure your Crypto assets are well-protected.

Utilizing the right tools for Crypto trading can help you make accurate investment decisions and maximize efficiency. Choose tools that align with your strategy and always prepare thoroughly to succeed in the cryptocurrency market.