Bitcoin, the most popular cryptocurrency today, has not only attracted significant attention from investors but also exerted a strong influence on the global economy. The rise in Bitcoin’s price is not coincidental but the result of many influencing factors. In this article, we will explore the key factors driving Bitcoin’s value upwards.

1. Bitcoin’s price history

Bitcoin’s first recorded transaction took place in 2010, just two years after this digital currency was introduced by its creator, Satoshi Nakamoto. At that time, Bitcoin was valued at around $0.05 per BTC. However, the first actual Bitcoin transaction occurred in 2009 when a user exchanged 5,050 BTC for $5.02 via PayPal, which placed the value of each Bitcoin at about $0.00099.

With continuous development, Bitcoin’s value has now risen to $58,000. This means that the current value of BTC is more than 1,160,000 times higher than its initial value, all within just over a decade. This is an astonishing change in value, reflecting the robust growth of Bitcoin and the cryptocurrency market.

Although Bitcoin’s price history cannot be considered a precise predictor for the future, it remains a crucial tool in assessing Bitcoin’s potential value in the coming years. By analyzing factors such as the number of holders, wallet addresses, global acceptance, and many other aspects throughout Bitcoin’s development, we can use this data to forecast the value trends of Bitcoin in the future.

2. Key factors driving Bitcoin’s price increase

2.1. Number of users

One of the most important factors driving Bitcoin’s price is the increase in the number of users. Since the total supply of Bitcoin is limited to 21 million coins, as the number of users increases, the basic supply and demand pressure will push Bitcoin’s value higher.

According to data from Statista, the number of verified cryptocurrency users globally has surged from 221 million in June 2021 to 575 million in June 2024, a growth of 160% in just three years. This indicates the significant growth potential of this market, suggesting that Bitcoin’s price could continue to rise as the number of users grows. Furthermore, if Bitcoin becomes legal tender in more countries (currently, only El Salvador recognizes Bitcoin as legal currency), this will increase the user base and, in turn, drive its value growth.

2.2. Cryptocurrency adoption

The adoption of cryptocurrency is closely tied to the increase in the number of users. However, “cryptocurrency adoption” is not just about the number of users; it also encompasses a wide range of use cases, such as international remittances and e-commerce. Many believe Bitcoin could become an alternative to gold, particularly in its role as a store of value, as central banks start using Bitcoin instead of gold.

Moreover, Bitcoin has the potential to replace gold as an integral part of global financial transactions. The ideal scenario would be for Bitcoin to be more widely accepted in international transactions and banking. The development of scaling technologies like the Lightning Network also contributes to significant progress in Bitcoin adoption and the use of other cryptocurrencies.

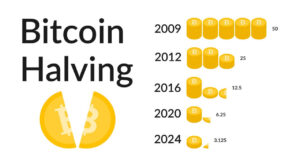

2.3. The impact of Bitcoin Halving events

An undeniable factor in Bitcoin’s price volatility is the “halving” events – a process that reduces the reward for Bitcoin miners. Halving is a programmed event that cuts the reward for mining a new Bitcoin block in half, which reduces the rate at which Bitcoin is supplied to the market.

History has shown that Bitcoin’s price tends to rise sharply after each halving event. The next halving is expected to occur in 2028, and there will be a total of 28 more halvings until all Bitcoin are mined in 2140. This creates scarcity for Bitcoin, contributing to the rise in its value in the future.

3. Bitcoin price prediction for 2040

If we use Bitcoin’s compound annual growth rate (CAGR) of approximately 13% over the past three years and apply it to future value predictions, Bitcoin could reach a price of $628,992 by 2040. This would mean that Bitcoin’s price would grow by more than 606% compared to its current value of around $89,000.

This forecast assumes that Bitcoin continues to grow at the current CAGR rate. However, it’s important to note that this is a relatively simple calculation and does not account for complex factors such as market volatility, overall investment trends, and external factors like global economic conditions or political changes. Despite this, the forecast can still serve as a useful starting point to visualize Bitcoin’s growth potential in the future.

Ultimately, Bitcoin’s price performance and its potential to become a profitable investment depend heavily on macroeconomic and political factors. To gain a clearer view of potential profits from Bitcoin, you can use our Bitcoin profit calculator, which allows you to adjust figures based on your specific investment situation.

4. Bitcoin price prediction for 2050

Similar to the 2040 prediction, we continued to use Bitcoin’s compound annual growth rate (CAGR) of approximately 13% over the past three years to calculate Bitcoin’s value in 2050. Based on these parameters, Bitcoin could reach $2.14 million by 2050, representing an increase of more than 2,304% over 26 years.

However, it’s easy to see that a 13% annual growth rate sustained over nearly 30 years is a challenging assumption, as almost no asset can maintain such a sustainable growth rate over such a long period. For this reason, we also attempted to predict Bitcoin’s price using the average annual return of the S&P 500 index over the past 50 years, around 11.13%. This provides a more stable benchmark for long-term forecasts.

In summary, the price of Bitcoin is not only influenced by the number of users or widespread acceptance, but also significantly impacted by halving events and technological developments. Looking towards the future, Bitcoin still holds significant potential to continue growing strongly and play a vital role in the digital economy.