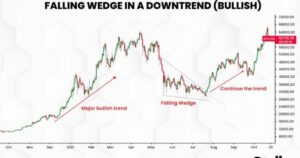

The Falling Wedge pattern is a crucial signal in technical analysis, typically emerging after a downtrend and indicating a potential bullish reversal. Accurately identifying this pattern enables traders to seize buying opportunities with an attractive risk-reward ratio. So, how can traders effectively recognize and trade the Falling Wedge pattern?

1. How to identify the falling wedge pattern?

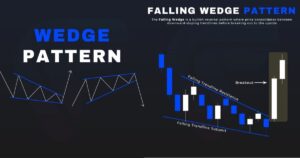

The Falling Wedge is one of the key patterns in technical analysis, helping traders spot potential reversal signals. To accurately identify this pattern, the first step is to observe the formation of two converging trendlines. The upper trendline is formed by a series of lower highs, while the lower trendline connects lower lows over time. As these two lines gradually narrow, they create a shape resembling a downward-sloping wedge.

Another important characteristic of this pattern is the presence of at least two reaction points on each trendline. However, if there are three or more points, the reliability of the pattern increases. This confirms that the price is moving within a contracting downtrend channel, signaling a potential trend reversal.

Additionally, the Falling Wedge is often accompanied by a decreasing price range. Although the price continues to make lower lows, the rate of decline slows down, indicating that selling pressure is weakening. This is a key signal that a market reversal may be imminent.

Another crucial factor to consider is declining trading volume. During the formation of the pattern, volume typically decreases, reflecting a loss of momentum among sellers. As the price approaches the convergence point of the two trendlines, a strong breakout often occurs, especially if there is a sudden surge in volume when the price breaks above the upper trendline.

2. How to trade the falling wedge pattern?

Once the Falling Wedge pattern is identified, traders can apply appropriate strategies to capitalize on this opportunity. One of the most common approaches is to wait for a breakout above the upper trendline with a significant increase in trading volume. This confirms that buyers have regained control of the market and that a new uptrend may be starting. More cautious traders may choose to wait for a confirmation candle to close above the upper trendline before entering a trade to avoid false signals.

2.1. Setting a stop-loss order

When entering a trade, setting a stop-loss order is crucial to protect your account from unexpected risks. Typically, the stop-loss should be placed just below the most recent low of the pattern or at a reasonable distance below the lower trendline. This helps traders manage risk in case the price does not behave as expected and continues to decline instead of reversing.

2.2. Taking profit

For profit-taking strategies, traders can measure the distance between the two trendlines at the beginning of the pattern’s formation. This distance is then added to the breakout point to determine the target price. However, since market conditions can be unpredictable, some traders opt for partial profit-taking to maximize returns while reducing risk. This approach ensures that traders lock in profits even if the price does not reach the full expected target.

3. Is the falling wedge pattern bullish or Bearish?

The Falling Wedge pattern is considered a bullish reversal pattern. Although the price is declining during the formation of the pattern, it often signals that selling pressure is weakening, paving the way for a strong recovery. When the price breaks above the upper trendline of the wedge, it serves as a key signal for a potential uptrend.

4. Is volume important in the falling wedge pattern?

Absolutely! Trading volume plays a crucial role in confirming the reliability of the pattern. In an ideal scenario, as the Falling Wedge forms, volume tends to decrease, indicating a depletion of selling pressure. Then, when the price approaches the upper trendline and breaks out, a surge in volume typically follows. This signals that buyers have stepped in, reinforcing the likelihood of a bullish reversal.

5. How to identify a breakout from the falling wedge pattern?

Not every price movement above the upper trendline of the Falling Wedge is a true breakout. To identify a reliable breakout:

- Significant increase in volume: If the price breaks out without a noticeable rise in volume, it might just be a false breakout.

- Decisive breakout: The price should close clearly above the upper trendline rather than merely touching or fluctuating around it.

- New highs: A stronger confirmation occurs when the price not only breaks the trendline but also surpasses the most recent peak within the pattern.

The Falling Wedge pattern is a valuable tool for traders to spot potential reversal signals and optimize their trading strategies. Combining pattern recognition, strategic entry points, and effective risk management can significantly enhance success rates. When applied correctly, this pattern can yield substantial profits in financial markets.

117 comments

Douglas340

Get paid for every referral—sign up for our affiliate program now! https://shorturl.fm/GLIbr

Gregory3577

Share our link, earn real money—signup for our affiliate program! https://shorturl.fm/8PxLf

Patrick2938

Unlock top-tier commissions—become our affiliate partner now! https://shorturl.fm/LiTPI

Johnny4350

Monetize your traffic instantly—enroll in our affiliate network! https://shorturl.fm/FehTz

Chance3990

Drive sales, earn commissions—apply now! https://shorturl.fm/h2E5B

Drew2005

Unlock exclusive affiliate perks—register now! https://shorturl.fm/TOZSQ

Rhys1240

Start earning instantly—become our affiliate and earn on every sale! https://shorturl.fm/Hfswz

Jayla3352

Drive sales and watch your affiliate earnings soar! https://shorturl.fm/anjAA

Natalie4110

Turn your audience into earnings—become an affiliate partner today! https://shorturl.fm/UFvfH

Patrick1107

Promote our brand, reap the rewards—apply to our affiliate program today! https://shorturl.fm/AiQn2

Mathew3890

Invite your network, boost your income—sign up for our affiliate program now! https://shorturl.fm/jt3V4

Mya3241

Tap into unlimited earning potential—become our affiliate partner! https://shorturl.fm/f6yxj

Ginger1342

Start earning passive income—become our affiliate partner! https://shorturl.fm/hXT9u

Breanna1441

Monetize your audience—become an affiliate partner now! https://shorturl.fm/ahg3i

Zane4683

Boost your profits with our affiliate program—apply today! https://shorturl.fm/QjzcF

Jamal2202

Earn recurring commissions with each referral—enroll today! https://shorturl.fm/tNgfT

Sam443

Tap into unlimited earning potential—become our affiliate partner! https://shorturl.fm/gjTsG

Rachel944

Share your unique link and earn up to 40% commission! https://shorturl.fm/84NzU

Blake585

Unlock exclusive rewards with every referral—enroll now! https://shorturl.fm/YHctZ

Nevaeh1107

Анатолий Папанов и Клара Румянова – Расскажи, снегурочка скачать песню и слушать онлайн

https://allmp3.pro/3339-anatolij-papanov-i-klara-rumjanova-rasskazhi-snegurochka.html